Photo courtesy of Getty Images.

Order-to-delivery (OTD) times for the 2017 model-year were comparable to those experienced by commercial fleets during the 2016 model-year.

The top factors that positively influenced OTD during MY-2017 were:

- A softening of retail demand that improved production allocation and reduced lead times, especially for trucks and vans.

- Greater availability of railcars, decreasing the incident of railcar shortages compared to prior years.

- OEMs issued fewer extended quality holds on new models.

- Milder weather that resulted in fewer weather-related delays.

“Similar to last year, 2017 order-to-delivery timeframes for most models remained relatively flat with delivery times for some models decreasing,” said Jessica Krams, manager, vehicle order management for Wheels Inc. “Almost all vehicle lines were delivered, on average, within or ahead of the OEMs’ posted lead time. For the most part, vehicle lines that experienced longer order-to-delivery timeframes for 2017 were accurately accounted for by the OEMs in their projected lead times. This was an improvement over past years.”

On the negative side, there were persistent difficulties in shipping product from Mexico to the U.S., resulting in delays and uncertainty as to the anticipated delivery date.

These were among some of the many findings that were revealed by Automotive Fleet’s 18th annual OTD survey, which is based on data and analyses provided by nine fleet management company (FMC) survey partners that included ARI, Donlen, Element Fleet Management, Emkay, LeasePlan USA, Merchants Fleet Management, Mike Albert Fleet Solutions, Union Leasing, and Wheels Inc.

The comprehensive OTD survey tracked actual deliveries of approximately 137,034 new vehicles during the 2017 model-year that were comprised of 103 different models.

The survey methodology calculated OTD times for cars from the day an order was placed with a factory, to vehicle delivery to a dealer (not driver pickup). Truck OTD was calculated from order placement to delivery to an upfitter or, if no upfitting was required, to a dealer. The days spent at an upfitter were not included in truck OTD times.

Stable OTD Times

All participating FMCs agreed that, on the whole, OTD times for 2017 models were relatively consistent with what was experienced last year with 2016 model deliveries.

“For cars and light trucks, order-to-delivery timeframes were fairly consistent in 2017. FCA had a slight increase in lead times due to constraints on diesel engines, but, for the most part, lead times tightened up and are steadier now that prior-year railcar issues seem to have calmed down,” said Nick Erculiani, VP, acquisitions for Element Fleet Management.

Making a similar observation was Jim Tangney, vice president of vehicle acquisitions for Emkay. “2017 model-year OTD times were pretty consistent with those of 2016 model-year vehicles with only small changes. These small variances are expected on a year-over-year basis and will always be present, so it’s important to always leave some leeway in your replacement timelines. Issues typically arise when an OTD timeline changes by four or more weeks,” said Tangney.

In addition to traditional OTD constraints, there were other factors that influence OTD delays. “This included unclear buildout information, shipping from upfitter to dealership, and overall increase in volume of orders and the ability to handle the large volumes,” said Erculiani.

As with prior model-years, the key factor in determining OTD was the time the original order was placed. “Orders placed later in the model-year saw longer delays. Orders that were placed earlier in the model-year had earlier production preferences and delivered in less time,” said Greg Carson, vice president, operations for Union Leasing.

Increasingly, fleets are heeding long-standing industry advice to place new-vehicle orders as early in the model-year, as possible.

“Fleet managers did a great job of placing orders well ahead of cut-off dates, which helped avoid over-allocation issues, delays, or even unfulfilled orders,” said Rick Smith, manager, vehicle acquisition for LeasePlan USA.

As this year’s OTD survey data revealed, the time to get a 2017 vehicle from the factory to the dealer was relatively flat; however, where problems persist is getting vehicles from dealers to drivers.

“It is not the OTD time that is the problem as much as getting delivering dealers to complete the process. In 24 years in this role, I don’t think it has ever been this slow, and unresponsive,” said Steve Armstrong, manager, vehicle purchasing for Mike Albert Fleet Solutions.

Reasons for OTD Improvement

There have been improvements in OTD times on certain models that experienced long lead times in previous years.

Smith of LeasePlan USA cited two factors that have helped improve OTD during the 2017 model-year.

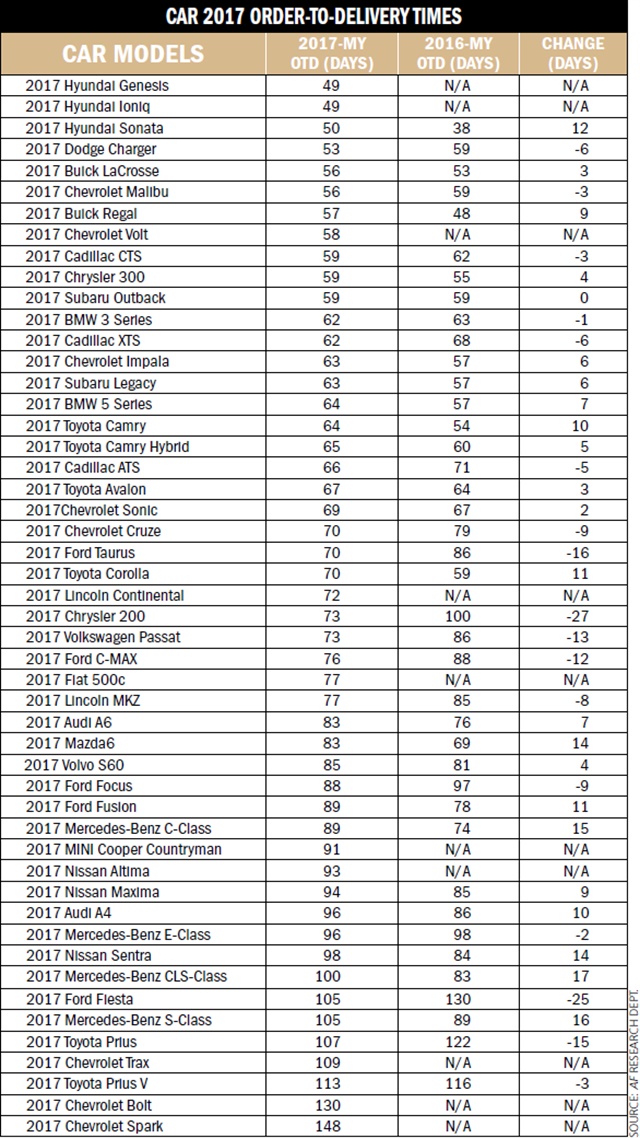

Car 2017 OTD times

“OEMs have added shifts to production plants for high-demand vehicles and larger parts capacity allowed for higher allocation levels,” said Smith. “Second, forecasting has improved from all involved parties (customers, FMCs, upfitters and OEMs), which has allowed for significant improvements in the overall order-to-delivery process.”

In addition, whether a vehicle was redesigned or a carryover model also has an impact on OTD. “Carryover vehicles that had not gone through a significant redesign were more quickly processed, built and shipped,” said Carson of Union Leasing.

Issues South of the Border

A key factor that contributed to OTD headaches were delays in the shipment of fleet vehicles assembled in Mexico.

“In general, vehicles built in Mexico have longer shipping times. Manufacturers have sought out alternate shipping methods to decrease cost and avoid rail congestion in the area. The manufacturers began shipping vehicles via vessel into the U.S. rather than via rail, which led to vehicles sitting for extended periods at the port in Mexico due to longer inspections at the port of entry in the U.S. and longer shipping timeframes from the port to the dealer,” said Krams of Wheels. “Nearly 60% of shipping delays we communicated to our customers this year were on vehicles produced in Mexico.”

OTD forecasts provided by the manufacturers generally held true for a majority of the 2017 model-year vehicles, and were largely similar to last year OTD times. In some cases, OTD was notably better for a number of truck and van models.

“While some vehicles produced outside of the U.S. had longer/extended lead times, the OEMs proactive communication helped to properly support our customers’ expectations. An improvement in vehicle logistics (railcar availability) had a positive contribution, as well as a softer retail demand trends,” said Partha Ghosh, director, vehicle supply chain – North America for ARI. “Weather and quality holds typically impact the delivery process, regardless of the model-year, but they were not a significant factor as has been experienced in the past.”

One vehicle segment that experienced higher OTD times in 2017 was medium-duty trucks.

“Medium-duty trucks had a slight OTD increase in 2017, pushing 20 weeks,” said Erculiani of Element. “Lead times for medium-duty trucks have started to move in a positive direction and remain consistent. This helps when we are working with customers to create solid replacement plans or with customers who have specific expectations when new vehicles need to be on road in order to take advantage of remarketing channels.”

Isuzu was one exception among medium-duty truck OEMs. “Isuzu has experienced increased growth while also effectively managing lead times,” said James Crocker, director of fleet operations for Merchants Fleet Management.

However, this sluggishness in other medium-duty deliveries was offset by faster OTD times for vans and SUVs.

“We saw a dramatic improvement in the van segment, with a decrease by 15 days from 103 to 88 days. This can be attributed to the Transit Van and the delays experienced last year with getting them in traffic,” said Elizabeth Kelly, vice president, vehicle acquisition and remarketing for LeasePlan USA. “The SUV segment also saw a decrease by four days to 68 days on average.”

Other participating fleet management companies reported similar OTD results.

“The OTD performance of the van sector stands out. This segment led the way this year with significant improvements across the board,” said Crocker.

Two specific van models that stood out were the Dodge Grand Caravan and the Ford Transit Connect. “These two vans improved the most with a decrease in over 30 days,” said Kelly of LeasePlan USA. “The improved time for the Grand Caravan can be attributed to the early cut-off and hold for the 2016-MY. FCA halted production of this model for over three months, which caused order-to-delivery times to be inflated. The 2017-MY Transit Connect also improved order-to-delivery times over 2016-MY. Last year, the 2016-MY Transit Connect was impacted by a door latch recall that created delays for this model.”

Some OTD timeframes were remarkably quick. “GM built some trucks and SUVs in four to five weeks and had vehicles delivered to dealers and/or upfitters,” said Erculiani of Element. “Some GM vehicles were built ahead of schedule and Element was not made aware of it, nor were we expecting the expediting of the order. This created some timing issues with upfitters, dealerships, and customers receiving vehicles earlier than expected.”

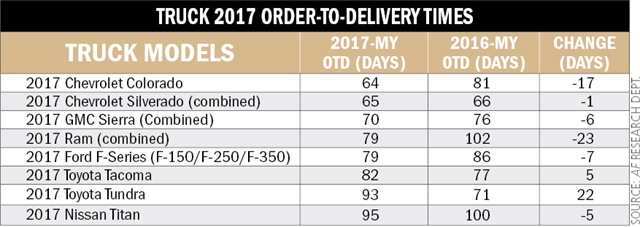

Truck 2017 OTD times

OTD improvements also occurred with the Dodge Ram 1500. “The Dodge Ram 1500 improved with less issues in equipment constraints compared to 2016-MY,” said Erculiani.

Another example of fast OTD was the Chevrolet Colorado, which is assembled at GM’s Wentzville assembly plant in Missouri. The efficiency of Wentzville assembly plant has resulted in a significant improvement in Colorado production.

“Overall, OTD times for 2017 remained constant and improved for some of the brands that Union ordered versus 2016. There were some differences based on a few models that had gone through a refresh, but nothing drastic on delivery delays. We also experienced some transportation issues based on where vehicles were produced and due to capacity and demand with individual models,” said Carson of Union Leasing.

In its survey data, Union Leasing reported some delays in the small pickup market. “Demand appeared to be strong for several manufacturers causing some production pain. As a result it put stress on both build times and on logistics. Completion times increased as did the time to transport to delivering dealers,” said Carson. “There were upfit delays for small trucks, which were attributed to capacity issues that the manufacturers and their established upfit groups had not adequately staffed to accommodate.”

Across the Board Improvements

Most OEM brands experienced improved OTD times for 2017 model deliveries.

“We have seen improvement across the industry. Chevrolet made strides in all three categories of cars, trucks, and SUVs. Chrysler also performed well, specifically in categories, such as trucks and SUVs where the market is shifting. Ford made gains in truck and van production, but still is lagging in sedan OTD. Nissan performed well with its van division, but fleet allocation for its Rogue and Altima still encounter speed bumps,” said Crocker of Merchants Fleet Management. “Nissan is integrating upfit status reporting into its regular status reporting offerings.”

On the whole, OTD for most 2017 models was relatively stable when compared to each model’s average OTD in the 2016 model-year.

“There were no dramatic changes in OTD for specific models. Many carryover models typically fell in the 8 to 10 or 10 to 12 weeks range. As noted earlier, a number of the key volume truck and van models across various OEMs showed improved OTDs and we have experienced some specific deliveries that occurred in the 6 to 8 week range, which was unheard of in recent years,” said Ghosh of ARI. “Presumably, a combination of logistical improvements and less volume pressure are factors in the improvement, and it’s still not clear yet whether or not these OTD gains will remain for the foreseeable future.”

Upfitter-related OTD Issues

One area of OTD improvement for the 2017 model-year was the reduction in number of vehicles that missed ship-thru.

“The OEMs have made significant improvements in reducing the number of vehicles that missed ship-thru, which unexpectedly increases the OTD in those instances and creates headaches for clients as upfit options can be impacted as well,” said Ghosh of ARI. “This was certainly a more significant issue in 2016 and previously, but while it still occurs, the improvement is definitely noticeable. In other instances, vehicles were delivered to dealers without the necessary parts to complete the upfit at the final destination, but most certainly, this was the exception and not the norm.”

Another factor cited by FMCs was consolidation in the upfit industry that led to delays in OTD.

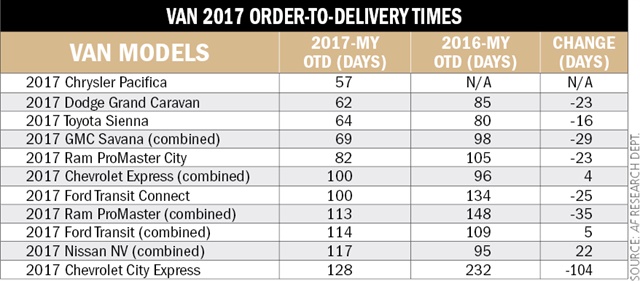

Van 2017 OTD times

“The upfit industry as a whole experienced several mergers and acquisitions this year. As a result, long established day-to-day and non-routine communication protocols were disrupted; suppliers were often unable to provide accurate and timely status information and we experienced occasional delays in getting vehicles completed. In addition, inadequate communication from some suppliers to the OEMs resulted in delays in vehicles returning to ship-thru traffic,” said Krams of Wheels.

Other FMCs also noted issues with upfitters undergoing management changes or after being newly acquired by another company.

“There has been many changes in the upfitter footprint due to consolidation of locations, business sales/purchases, and vendor growth. We have seen a number of production delays from upfitters due to supply chain management, unforecasted high volume increases in many industries, integration of business models, and shortage of qualified staff,” said Erculiani of Element.

This was also echoed by Crocker at Merchants Fleet Management. “There were a small number of upfitters that have seen an increase in lead time and response time due to activity and management changes.”

However, participating FMCs noted that communication from upfitters has improved. “Manufacturers, transportation companies, and upfit suppliers continue to improve communication regarding delays. Timely communication is coming forward now more than ever,” said Kelly of LeasePlan USA.

However, the key problem continues to be the increased volume of upfits that is taxing the resources of upfitters to complete units on time.

“The entire upfit industry is still experiencing a supply/demand problem. It can take up to two to three months just to get a truck through ship-thru, and back to the dealer. Add that to the three to four months for the production, and that simply doesn’t meet the client’s business needs,” said Armstrong of Mike Albert Fleet Solutions.

This assessment was echoed by Erculiani of Element.

“Because of high volume orders, there were some upfitters who seemed overwhelmed at the number of orders at any one time,” said Erculiani.

As non-traditional fleet OEMs increase the number of fleet units sold, they are perfecting their OTD procedures. “For instance, there has been an overall increase in Nissan orders. Nissan has put significant effort into improving upfit visibility in working with their suppliers, making system improvements, and overall having a true upfit process in place. In 2017, Nissan upfit orders felt very much like Ford, GM, and FCA’s ship-thru process. This was timely as Nissan orders increased by as much as 300%,” said Erculiani of Element.

The participating FMC survey partners cited more fleets are ordering vehicles for upfitting beyond the traditional fleet suppliers of Ford, GM, and FCA. This trend started to be noticeable in the 2016-MY ordering cycle.

“Nissan has done a fantastic job at listening to Element and other FMCs and responding to this change in the industry by partnering with an upfitter. These same customers used to order from the traditional Big Three and expect the same experience when it comes to timeframes and visibility to orders,” said Erculiani of Element Fleet Management.

However, non-traditional fleet OEMs still have more progress to make. “The Japanese and Korean manufacturers still have a long way to go in modernizing their systems to adequately provide status at every movement. Unfortunately, our clients live in an ‘Amazon’ world, where instant exact status is expected,” said Armstrong of Mike Albert Fleet Solutions.

Crossover 2017 OTD times

While there may not have been significant upfitter-related issues this model-year, problems did arise when OEMs did not adequately communicate changes to vehicle specifications that impact the installation of an upfit package.

“A change in vehicle specs can cause delays through an upfitter, especially if the upfitter is not aware of the changes. Vehicle configuration and new technology and safety components incorporated into a vehicle by the OEM can require reengineering for the upfit package. If a client has requested a change after the initial upfit was approved and parts were ordered, delays may occur,” said Bill Gooden, vehicle upfit consultant for LeasePlan USA. “Some upfitters have annual plant shut downs, which in turn increase OTD.”

The complexity of the upfit requirements can impact OTD. “In addition, the relationship that the manufacturer has with their approved upfit source is important,” said Carson of Union Leasing. “Although some manufacturers feel they should not be accountable for upfit delays, the end-user often sees it differently. A fleet best practice is to anticipate the OTD and manage to that estimate. Fleets look to the manufacturer and the FMC to get their inventory within the communicated delivery estimate when originally selecting vehicles.”

Increased Use of Pools

One ongoing factor that is helping to stabilize OTD delivery times is the increased use of OEM pools and upfitter bailment pools.

“This past year Element has seen an increase in customers ordering pool vehicles either through a customer pool process or utilizing a bailment pool process,” said Erculiani of Element. “There has been a 3% to 4% increase in pool ordering.”

Crocker of Merchants noted that there has been an increase in upfitter bailment pool interest among fleet managers as a way to reduce lead time in place of factory-direct orders.

“Visibility on bailment pool vehicles is also an opportunity that we would like to see OEMs focus on more closely,” said Crocker.

Union Leasing is a strong proponent of the use of OEM pools. “The use of manufacturer pools positively contributed to more timely delivery for some of the trucks and vans that Union ordered. Some of this was planned by Union in advance for larger clients utilizing common vehicle types and some a result of manufacturers who were willing to allocate advance inventory supply to fleet,” said Carson of Union Leasing.

Toyota was one of several OEMs that was an early leader in the creation of pool vehicle availability, which helped to improve its OTD delivery times.

“Toyota continues to show the most improvement in OTD because of their expansion of the e-pool availability,” said Erculiani.

0 Comments

See all comments